The DC Chamber of Commerce Government Affairs Committee continues to advocate on behalf of our members. We are excited to share that an opinion piece by Chamber President & CEO, Angela Franco, was published in the Washington Business Journal on April 3, 2023.

FY 2024 Budget

On April 14, 2023, Angela Franco provided testimony in front of the Committee of the Whole. Angela stressed the need to preserve investments for our Central Business District recovery and fund pro-growth measures that remove obstacles to starting and running a successful business in the District. Angela’s testimony can be found here.

The Council has now completed public hearings and individual committee budget mark-ups. On May 3rd, the Committee of the Whole (COW) will convene a working budget session to reconcile the various committee mark-ups. Here is a link to find individual committee reports. The COW will hold its first budget vote on May 16th. The second, and final, budget vote will be May 30th.

The Chamber has identified the following Council proposals impacting the business community:

DC Cashout Law

Attention DC Chamber Membership!!

Please join the DC Chamber and our business partners to oppose efforts by the DC Council to impose penalties on employers who provide their employees with parking benefits.

In an effort to advance the District’s economic comeback the Mayor has proposed a 3-year delay in the DC Parking Cashout Law, which would force employers to pay for new climate mandates. But the Council is now moving to reverse that sensible delay and impose the mandate as soon as this fall. If that happens, employers with 20 or more employees must either offer a new Clean Air Fringe Benefit, develop a “transportation demand management plan”, or pay a Clean Air Compliance fee. Employers must also prepare and file bi-annual progress reports.

As the Mayor and the Council work to revitalize the city, most especially our downtown commercial corridor, this is the wrong time to make it harder to do business here.

We need your help!

Please click HERE to send a message to all Councilmembers urging them to postpone this costly new business mandate.

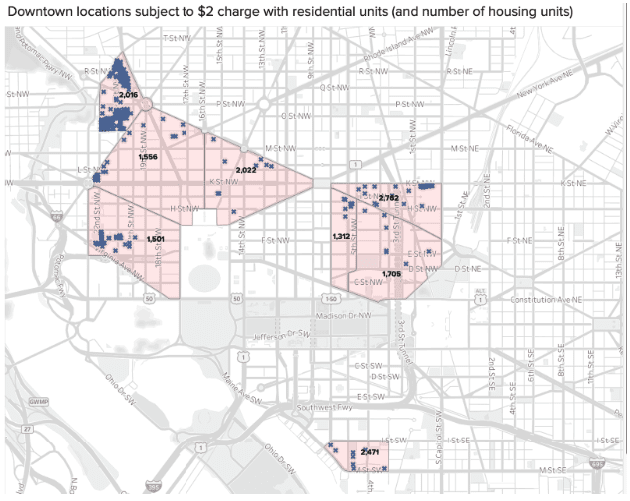

$2 Surcharge on Downtown RideShares

The DC Council is considering a new tax on all those who use ride sharing to get in and out of town. The $2 charge would be added to all for-hire vehicle ride fares (Uber, Lyft, etc.) both going into and leaving from downtown every day of the week between 7:00 AM and 7:00 PM.

There are a number of problems with the ride tax, including the following:

- The budget proposal that was sent to the Council included no new taxes or fees on residents or businesses. But the Council is now poised to raise taxes on our residents as they move about the city. This is not the time to raise taxes on our residents.

- Despite the fact that there is already a 6% tax on all rideshare trips, the Council wants to add a brand-new tax on top of that existing tax.

- All of us want to see DC make a strong economic recovery but making it more expensive to live and work here makes that recovery much harder to achieve.

- Downtown DC has been particularly hard hit by the pandemic shutdown. Many downtown office employees, including thousands of federal employees, have yet to return to full in-person work. As a result, many small business workers who no longer serve these daily customers have suffered through reduced hours and painful layoffs. Many of their employers have been forced to close permanently. Now is not the time to raise taxes on downtown customers and workers.

- Many agree that one way to revive downtown is to create attractive opportunities for more residents to live there. But the way the ride tax is structured would hit these residents the hardest — every day they catch a rideshare leaving or returning home.

- Supporters of the ride tax want those who would be forced to pay it to take the bus or ride a bike or a scooter instead. But rideshares are popular for a reason – residents and workers have come to rely on them. Nearly a third of all DC rideshare rides start or end in low-income areas, more than half of all riders are members of a community of color, and many others have a disability or an infirmity which prevents them from relying on other options. For these customers, rideshares are literally the key to their freedom and mobility.

- Supporters say the ride tax is needed to combat “congestion.” But there is no credible evidence in support of a “congestion fee” so it is basically a solution in search of a problem.

- The ride tax will also hurt rideshare drivers, 88% of whom are members of a community of color.

- The Council is weighing this new tax in the final hours of their budget process, without the benefit of any public hearing or other formal input from those who would be forced to pay it. This is not a fair way to place yet another tax burden on our residents.

We urge DC Chamber members to contact your Councilmember to voice your opposition to this harmful legislation.

Key Council budget mark-ups/proposed changes:

i. Funding Mendo/Allen fare-free Metro buses – 2 Council proposals:

1. A $2 “congestion fee” for ride sharing in and out of the downtown area at peak hrs

2. Zeroing the Mayor’s $123M K Street Transitway funding – CM Allen.

ii. CM Allen’s mark-ups:

1. Moves up the Mayor’s mandated parking benefits deferral.

2. Moves auto ticket $ from general fund back to DDOT street safety.

3. Rejecting Bowser’s proposed 3-yr. delay in Building Energy Performance Standards (BEPS), eliminates time for owners and occupants to comply.

4. New Sustainable Energy Trust Fund fees — $31-$46 increases in every resident’s annual energy bills.

5. $20M in cuts to the Mayor’s road/sidewalk repair budget.

6. 4-yr. delay in Benning Rd. construction & Ward 7 streetcar extension.

iii. CM McDuffie’s mark-ups:

1. $3m cut to the Great streets and Small Business Fund.

2. $7M cut to the Food Access Fund.

3. $1M cut to the Festival Fund – “a Comeback Tool.”

iv. CM Bonds’ mark-ups:”

1. Zeroing funding for employee recruitment and retention.

v. CM Janeese Lewis George’s mark-ups:

1. 20% reduction in the Department of General Services FY ’24 budget.

vi. CM Henderson’s mark-ups:

1. $1.7M cut to Dept. of Behavioral Health FY ’24 budget

2. $225k cut to sr. dental services.

vii. CM R. White’s mark-ups:

1. $4 cut in the Home Purchase Assistance Program

2. Zeroing the $2M Heirs Property Assistance Program

3. Mandating that DCHA meet private sector consumer protection laws.

viii. CM Pinto’s mark-ups:

1. Reversing the planned sunset of the Criminal Code Reform Commission

2. $1.1M in cuts to 2 Public Safety agencies.

ix. CM Nadeau’s mark-ups:

1. $2 Rideshare fee (see above).

2. Reallocating $4.8M in DPW overtime fees to fill vacant positions.

3. Zeroing out $3.4M allocated for anti-rat Supercan replacements.

4. $2.1M cut to the Transport DC program, reducing trips by 25,000.

x. The Chairman’s mark-ups:

1. $62M in cuts to DCPS ($22 recurring/$40 one-time) redirected to indiv’l schools – including Ward 3 schools — (and possibly charters), “a clumsy and blunt mechanism putting schools – rather than students – first.”

DC Council Legislative Activities

B25-0114 “Stop Discrimination by Algorithms Act of 2021”

The “Stop Discrimination by Algorithms Act of 2021,” seeks to prohibit the use of algorithmic decision-making in an unlawfully discriminatory manner and would require corresponding notices to individuals whose personal information is used in certain algorithms to determine employment, housing, healthcare and financial lending. The measure was recently refiled in the new Council session by Councilmember Robert White, Jr., who championed last year’s bill, along with co-introducers Lewis George, Allen, Parker, and Bonds. The bill has now been sequentially referred to the Committee on Business and Economic Development chaired by Councilmember McDuffie, and the Committee on Judiciary and Public Safety chaired by Councilmember Pinto. Last year, the Chamber led a successful effort to delay formal action on the bill. This year, we intend to focus our efforts on defeating or, if necessary, fixing this legislation. We anticipate further consideration of the bill following the Council’s work on the FY 2024 budget over the next few months.

B24-0454 “Rediscover Equitable Central Occupancy Vitality and Encourage Resilient Yield (Recovery) Amendment Act of 2021”. This legislation would provide an economic recovery package for the Central Business District (CBD) including incentivizing mixed-use conversions and new businesses to locate in the Central Business District. It would also provide temporary tax relief for innovative businesses that locate in the CBD and meet hiring and economic inclusion requirements. The bill, filed by Councilmember Pinto, was heard by the Committee on Business and Economic Development last year. The bill was reintroduced on March 20th under B25-0228 as an updated/enhanced version of the previous measure. Councilmember Pinto seeks to move the bill, but is encountering obstacles to funding it in the BSA.

B24-0301 “Business and Entrepreneurship Support to Thrive (BEST) Amendment Act of 2021”.

This measure, unanimously passed by the Council in December 2022, would streamline basic business licensing processes for new and existing businesses. Among other things, it reduces the number of basic business license categories from over one hundred to ten. It lowers initial license fees and removes outdated or duplicative requirements. The bill is subject to appropriation, however the Mayor has not funded the bill in the FY24 proposed budget.

Committee Updates

DC Chamber Technology Subcommittee

Would you like to understand and leverage different technology trends to protect and grow your business? If so, the DC Chamber of Commerce Technology Subcommittee may be the right forum for you. The subcommittee will help members take advantage of technology to improve their businesses and serve their customers better. It will also connect members with fellow members in the technology space and give voice to members on technology-related legislative and other government relations matters. If you are interested in joining the Technology Subcommittee, please contact Brett Allen ([email protected]) or Kevin Wrege ([email protected]).

Scorecard

The Chamber is forming a working group to build on the success of our first-ever Council Scorecard. The group will consider enhancements to the current Scorecard. Please notify Brett Allen ([email protected]) or Kevin Wrege ([email protected]) if you are interested in participating. To download and view the full scorecard, please visit https://dcchamber.org/2022-scorecard.

Tax Revision Commission

With the help of our expert working group, the Chamber provided the DC Tax Revision Commission a series of initial recommendations at a public stakeholder input session last month. (See attached.) The Commission has asked us to provide feedback on other tax proposals, including a new “Business Activity Tax.” If you are interested in joining our tax working group, please contact Brett Allen ([email protected]) or Kevin Wrege ([email protected]).